Resilient, purpose-driven 'zebras' are the future – how can investors help them thrive?

The era of the unicorn – startups valued at US$1bn or more – is over, some say. Enter the zebra: resilient businesses that pursue both purpose and profit. But for zebras to flourish, a big mindset shift among VCs is needed. Industry insiders discuss what needs to change and why.

“Unicorns are obsolete.” At least according to Rudy Aernoudt, professor of corporate finance at the University of Ghent and senior economist at the European Commission, who was speaking at a recent ‘Impact Fire Talk’, hosted by FASE and moderated by event partner EVPA.

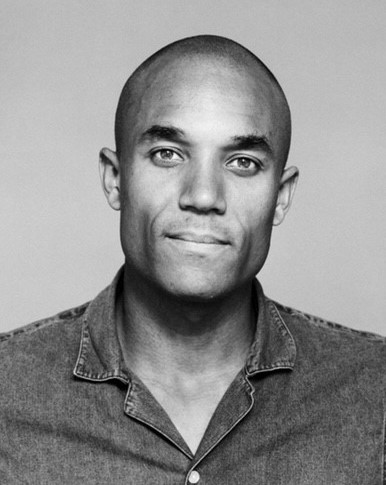

The world had reached a state of “perma-crisis”, Aernoudt (pictured) explained – with crises happening every three to five years, be it conflict, pandemics, high inflation or financial downturns. In this context, it was important for businesses to prioritise resilience, and this was “completely different from striving for short-term profits”, which many businesses – and their investors – still tended to focus on.

He argued that businesses, to be resilient in the long-term, need to be value-driven rather than only focusing on profits – and he insisted the venture capital sector’s focus on “unicorns” (startups that reach US$1bn valuation or more) was misplaced.

He argued that businesses, to be resilient in the long-term, need to be value-driven rather than only focusing on profits – and he insisted the venture capital sector’s focus on “unicorns” (startups that reach US$1bn valuation or more) was misplaced.

“I believe the era of the unicorn is over, and the future, to stay in the mythology of animals, is zebras,” he said, referring to companies that pursue both purpose and profit, such as impact ventures or social enterprises.

I believe the era of the unicorn is over, and the future is zebras

But for such zebras to flourish, big shifts are needed in the financial sector, speakers at the Impact Fire Talks event argued. Panellist Zoé Constantin, partner at impact asset manager Impact Partners, said that impact investing was far from mainstream and remained only “a very small part of the investment universe”.

- Read more in this series: Deep impact – or just managing risk? Pathways from ESG to investing for system change

Longer time horizons

The current VC mindset – looking for startups with exponential growth curves, that investors can exit after a few years with double-digit returns – was incompatible with the longer-term needs of impact businesses, speakers emphasised.

Aernoudt said: “The biggest problem with impact is that time to market is very long… The strategy of most VCs is to get out after three to five years, even for impactful investments – this does not fit with the business model of impact startups.”

The strategy of most VCs is to get out after three to five years – this does not fit with the business model of impact startups

Constantin added that impact investors knew that “the rule” with impact companies was that they needed long-term investment because they tended to need more time to establish a profitable business model.

Constantin added that impact investors knew that “the rule” with impact companies was that they needed long-term investment because they tended to need more time to establish a profitable business model.

Impact Partners manages 10-year funds, although Constantin acknowledged that ideally, they should be evergreen to provide longer time horizons to impact entrepreneurs. But evergreen funds were much harder to fundraise for, she explained, especially when working with institutional investors. Therefore, all types of investors – whether VCs, private equity funds or business angels – needed to understand that investing in impact means investing patient capital. “Otherwise, it’s not worth [it], because impact needs the time”, she said.

Investor education

Investors needed to be educated on what impact investing entailed, speakers agreed, because they often expected as much from impact funds’ financial performance as they did from conventional funds. “When you talk to investors, they think it's fantastic to do impact investing, but they still require exactly the same requirements financially, as if you were not an impact fund. So you have a kind of double hurdle,” said Impact Fire Talk attendee Olivier de Duve, who is founder and managing partner at impact VC firm Inventures.

Constantin echoed his frustration: “Investors are maybe not yet aware of what it means to invest in impact and that it just cannot be the same as business as usual,” she said, though she added that this mindset seemed to be evolving: “We are in a transition period and hopefully it will not last too long.”

Pricing in positive and negative impact

One reason why investors did not treat impact funds differently was that positive impact was not priced into a company’s valuation, de Duve pointed out.

“The positive externalities that impact funds and impact entrepreneurs create are not valued properly,” he said. “The system doesn't pay you back for the positive externalities that entrepreneurs are creating and that's frustrating.”

The system doesn't pay you back for the positive externalities that entrepreneurs are creating and that's frustrating

Speaker Walter Zantinge (pictured), co-founder of impact business Wholy Greens, confirmed this phenomenon from his experience of raising investment. For this reason, he focuses on building a sustainable supply chain with partners – and potential future buyers – that are aligned with his values.

Speaker Walter Zantinge (pictured), co-founder of impact business Wholy Greens, confirmed this phenomenon from his experience of raising investment. For this reason, he focuses on building a sustainable supply chain with partners – and potential future buyers – that are aligned with his values.

Constantin went even further, saying that the biggest problem was that the “detrimental externalities of [conventional] investments weren’t priced in”. For example, one could outsource production to a factory that saves money through cheap labour but ultimately costs society by making workers sick because of poor working conditions. Nor were we able “to factor in impact and resilience in the price at exits,” she said. Zantinge shared her concern: “I’d really love to see people use impact data”, he said.

Work is in progress to develop a methodology to put a monetary value on impacts, both positive and negative. In particular, the Impact Weighted Accounts Initiative at Harvard Business School – now led by the International Foundation for the Valuation of Impacts – advocates for impact to be priced and published in companies’ accounts.

- Read more from Sir Ronald Cohen on impact valuation: ‘Impact transparency’ is the tipping point for an impact economy

Catalysing power

For “zebras” to find the investment they need, the impact investing market needed to grow and become more mainstream – and public money was a great source of the patient capital to mobilise private investment, Aernoudt argued. He pointed out that 42% of VC capital in Europe currently comes from government-backed sources – like the European Investment Bank, some development finance institutions, and others. If this capital was redirected towards impact funds, it could have a strong catalysing power to build the impact investing market.

In the end, the calls to action in this Impact Fire Talk were clear: “Investors, if you have money, go change the world and only invest in impact”, Aernoudt said. Or, as moderator Inès Mertens from EVPA summarised: “Let’s go bold through the crises”.

This feature was produced in partnership with FASE. Catch up on more insights from the Impact Fire Talks series, and register now to join the next talk on 14 November.

Top photo: Zebras in Nairobi national park, by Grace Nandy on Unsplash